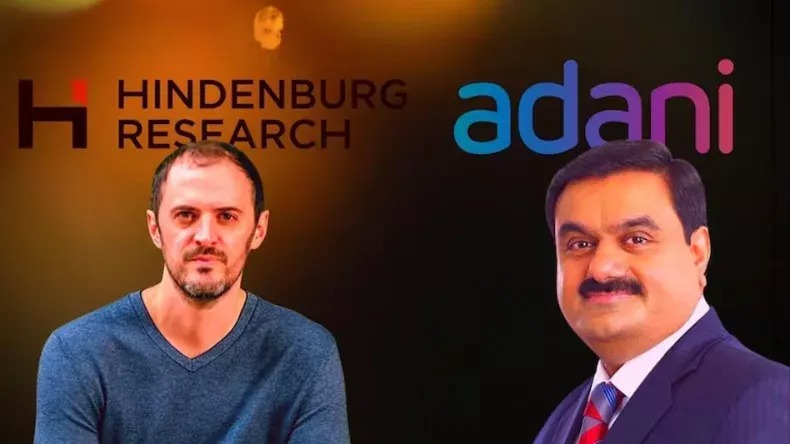

New Delhi: American short seller firm Hindenburg Research has once again made a big claim in a new case related to the Adani Group. This time their target is Securities and Exchange Board of India (SEBI) Chairperson Madhavi Puri Buch and her husband. According to the report, both of them have had a stake in the offshore funds used in the Adani money siphoning scam.

Report claims

Hindenburg Research in its latest report said that the allegations they made against the Adani Group 18 months ago revealed a large network of Mauritius-based shell companies. These companies were being used for undeclared transactions, investments, and stock manipulations worth billions of dollars in suspicious ways. Despite this network, SEBI has not yet taken any public action against the Adani Group. Instead, SEBI sent a 'show cause' notice to Hindenburg on June 27, 2024.

SEBI's attitude and Hindenburg's response

According to Hindenburg, SEBI did not find any factual errors in their 106-page analysis, but termed the evidence as insufficient. After this report, questions are being raised about SEBI's attitude, especially when it is being claimed that the SEBI chairperson also has stakes in offshore entities.

January 2023 Reveal

Earlier, on 24 January 2023, Hindenburg published a report accusing the Adani Group of stock manipulation and auditing fraud. He described it as the 'biggest scam in corporate history'. After this report, the shares of Adani Group fell sharply, leading to a major drop in Gautam Adani's wealth and ranking. However, SEBI had rejected Hindenburg's claims at that time.

Further investigation and possible impact

Hindenburg's new revelations have raised serious questions on the independence and impartiality of SEBI. If a thorough investigation is conducted into this matter and the allegations are proven to be true, then SEBI's reputation may be seriously affected. Now it remains to be seen what stance SEBI takes in this matter and what action the government takes on this.

Share

Share

_458360041_124x80.jpg)